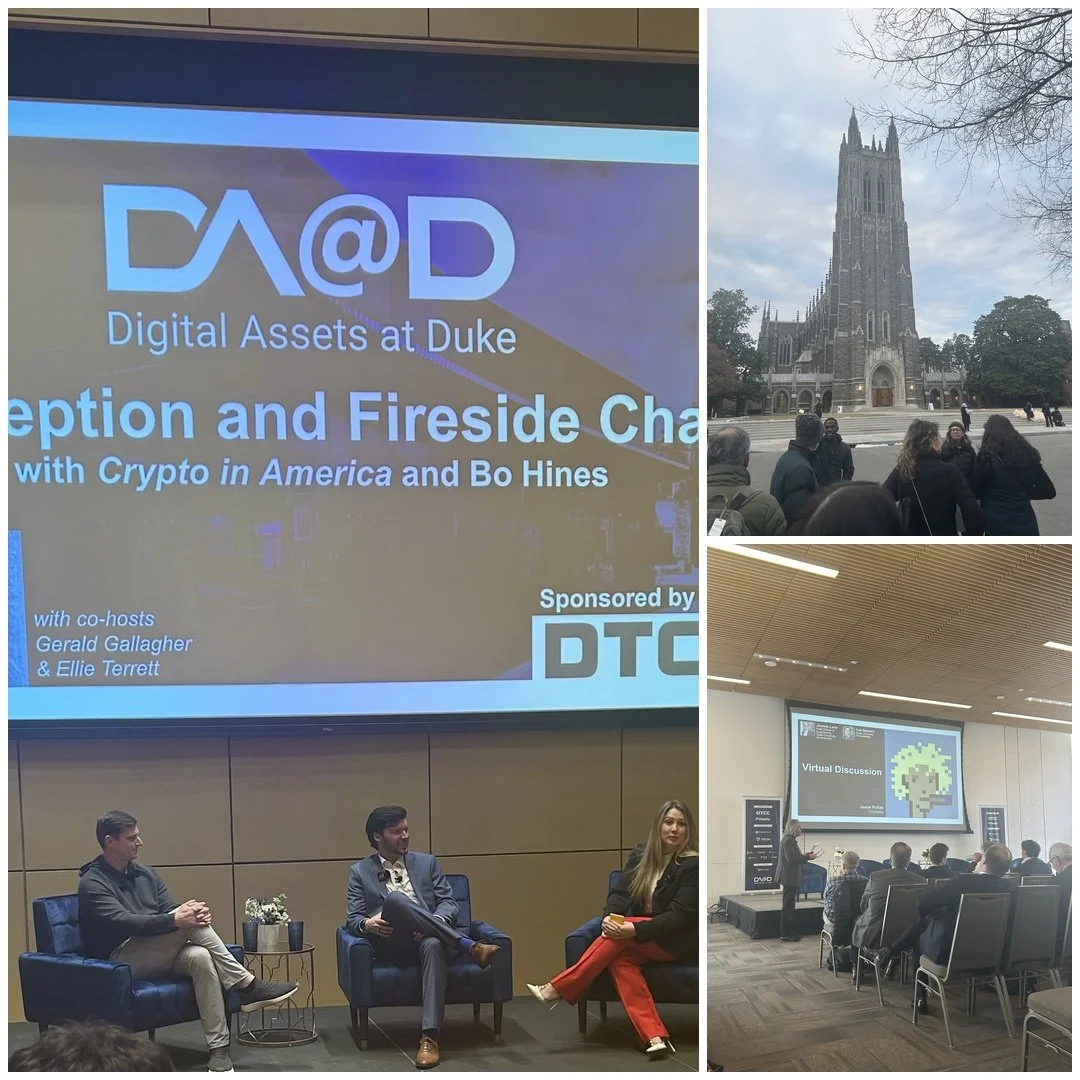

Digital Assets @ Duke: Signals From The Next Phase Of Onchain Finance

I spent February 4–6 at the Digital Assets @ Duke conference. Across regulators, institutions, builders, and investors, one idea was consistent: this market is a stress test.

Not just for crypto, but for any organization working with digital assets. In this environment, ambition matters less than execution.

Rather than cataloging speakers or projects, this post distills a few core themes that feel most durable as onchain finance moves from experimentation into real infrastructure.

Payments Innovation - The Sovereign Pushes Back — Moderated by Jimmie Lenz (Duke University) with speakers Zack Chestnut (JP Morgan) and Tom Zschach (Swift).

Institutions Are Optimizing, Not Evangelizing

The institutional shift is no longer ideological, it’s operational.

What matters now:

Capital efficiency, especially around collateral

Consistent treatment across custody, risk, and operations

Systems that integrate without introducing new failure modes

A single design question underpins much of this: Is the token the asset, or a representation of it?

That answer will shape custody, regulation, and market structure more than any individual protocol choice.

The message from Duke was clear: financial infrastructure isn’t being replaced. It’s being extended, and only where the gains are concrete.

Tokenization Is About Programmability, Not Speed

Tokenization is often framed as a settlement upgrade. A more grounded view emerged: speed alone isn’t the breakthrough. Many asset classes already settle quickly.

The real advantage is programmability:

Automated compliance

Embedded corporate actions

Shared, real-time state across institutions

Fewer reconciliations across middle and back offices

The impact isn’t just lower costs. It’s freed-up capital and operational capacity that can be redirected toward growth and innovation.

Stablecoins and Use Cases Are Converging Around Core Functions

Stablecoins are transitioning from crypto-native tools into financial infrastructure.

Adoption is expanding beyond trading into payments, treasury, funding markets, and commercial workflows. Over time, this activity is likely to consolidate around a small number of trusted rails.

Where adoption is real, it tends to cluster around familiar functions:

Tokenized cash and yield-bearing instruments

Funding and collateral markets

Private and illiquid assets

Improved transparency around ownership and control

These are not edge cases. They are foundational market functions.

Software Is Becoming a Financial Actor

Another emerging theme was the rise of autonomous software, agents that can operate continuously, transacting and managing assets on a user’s behalf.

If this model takes hold:

Wallets may rival bank accounts in importance

Identity, permissions, and capital management converge

Capital becomes continuously active rather than episodic

What stood out was how grounded these discussions were. This is increasingly treated as an architectural direction, not speculation.

Infrastructure Is Being Evaluated More Rigorously

Core systems are being judged less on raw performance and more on fundamentals:

Trust and governance

Privacy and permissions

Usability and developer experience

Ecosystem alignment

Traditional labels matter less than whether systems are reliable, composable, and usable at scale.

Closing Thought

The takeaway from Duke wasn’t hype, it was conviction.

The market is moving from experimentation to integration; away from narratives and toward measurable outcomes. What matters now is not what’s possible, but what holds up under real constraints.

Stress tests don’t eliminate good ideas. They expose which ones were real all along.

Follow Hgraph for more